New financials have just become available along with results of the Chambers survey, and questions from this author, and others, whether it be about flawed survey results or the financial state of affairs, continue to go unheeded and unheard. That being said and to be addressed later in this article, the following question and concern rises to the top:

What is the $192,739 reduction in equity since year end 2018, and where exactly did it go? (1) (2)

- Also, what accounts for the $124,698 decrease in net income and corresponding reduction to equity for 2017? (3) (4) (7) (8)

- And further, what accounts for the $47,051 decrease in net income and corresponding reduction in 2016 equity. (5) (6) (8) (9)

It should be noted that year end income was decreased in 2016 and 2017, but the corresponding reductions to equity were spread out in the first three months of the following year, after which equity and net income closely reconcile to property owners’ equity on the audited year end financial statements. Equity transactions such as these are non-standard at best.

Adjustments to equity and income that do take place, generally occur simultaneously at year end. Likewise, any CPA mandated adjustments would come with an explanation or note included in the audited financial statement.

Of further concern looking back, December/year end net income and equity figures provided to property owners in the 2016 and 2017 financial packages differ from the net income figures historically referenced the following year. (7) (8) (9) And these same figures also differ from the audited financial statements.

And while no current adjustments to 2018 income are presently available, it can definitely be noted that the unusual reductions to equity totaling $192,739 have likewise been spread out in the first three months of this year. (1) (2) Does this also mean that 2018 net income which was already under budget 466k will be reduced another $192,739?

Needless to say, any fiscally responsible and transparent board would inform property owners of any known changes and adjustments to equity and/or net income such as these. Unfortunately, no such notifications can be found in any board or committee minutes. Likewise, if lacking answers to these questions, the responsible and transparent board would launch an immediate independent investigation to determine the origin of these issues.

And one might ask, how was this inconsistency discovered? Just last writing, it was noted that one of the many questions asked of the board, without response, had been:

-

Why did December 2018 show an anticipated and budgeted net loss ($141K) for the month with administrative payroll, public works payroll, public works operating expense and public safety payroll being the largest contributors to this loss. It was further noted that budgeted losses also occurred in December 2017 and 2016 as well. Budgeting such a large loss in a single month seems unusual considering our accounting is based on the accrual method. This question remains unanswered. (7) (8) (9)

After looking at the referenced statements more closely to find the loss indicated for the previous year, one could see that the loss figures for the month, originally provided to the property owners, were substantially less than the adjusted loss figures provided the following year. So, that leads to even further questions.

-

How did the POA lose $236k in one single month during December 2017? What accounts for that loss? (7)

-

And how did the POA lose $162k in one single month during December 2016? What accounts for that loss? (8)

-

And if, this trend/logic is repeated this year, how did the POA conceivably lose $333k during December 2018? And what accounts for that loss? (1) (2) (7)

These large single month losses are particularly troublesome considering they always occur in the month of December, and that other months during the year generate a net income, with the exception of several extraordinary but explained occasions.

Many information requests and questions have been submitted to the board over the past five months, yet no answers to any financial questions have been received which leaves editorial writings as the only outlet to continue the dialogue.

Now to wrap this up with a few comments about other issues discussed in previous articles.

-

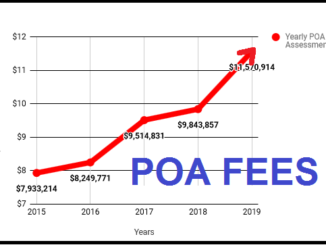

To be clear, this community can not fund any additional capital projects such as might be suggested by Chambers without an increase in property owner assessments and/or initiation fees. The current 2019 budget and capital plan allows only $103k for unexpected expenditures much less new capital projects. Why are we even discussing this at this time? (10)

-

And further, even after obtaining a $20 monthly increase in property owner assessments, the POA is unable to meet the present budget as it is already $26k under plan. (11)

-

Food and beverage losses already exceed budget $62k and exceed 2018 losses as well. In fact, payroll expenses alone totaling $384k exceed the actual food revenues before even factoring in cost of sales and operating expense. This can not be sustained, and presently, management and leadership do not seem to know why or where these losses are occurring. (12)

In closing, it is inconceivable that our community could have such substantial amounts of money in the form of losses that have not been explained. Likewise, it is equally troublesome, that the original financial packages provided to the property owners did not include the reductions to income and equity nor did they reconcile to the audited financial statements.

For now and as long as we continue to have unanswered questions, unexplained losses and uncontrolled expenses, it is requested that leadership step up and focus all attention on tackling these issues and doing so quickly in order to head off any potentially devastating and unforeseen consequences.

Patricia Cross

10438 Big Canoe

Please feel free to distribute and pass it on.

References:

-

BCPOA – Comparative Balance Sheet – 1/31/2019*

* [Author’s Note: Equity at December year end 2018, $32,543,349 plus year end net income, $970,280 less equity at year end from March 2019 balance sheet, $33,320,890 = ($192,739)] -

BCPOA Financial Package, 3/31/2019, YTD Amenity Results, Pg. 13

Be the first to comment