BIG CANOE POA RECORDS REQUEST 0004:

“Accounting Records ~ Developer Assessments” sent Wed, Aug 29, 2018 11:52 am

To: Jill Philmon / Big Canoe General Manager

Cc: The POA Board

Please find attached a 3 Page PDF Request to Review and Copy Records, made pursuant to Big Canoe Policies and Related Procedures; Procedure 156.2 (POA Member Access to Records)

http://www.bigcanoe.themountainsvoice.com/docs/RecordsRequestToGMandBoard-0004(2018-08-30).pdf

OVERVIEW OF REQUEST: The Developer is required under the Declarations and Covenants to pay Assessments on the land it owns within Big Canoe, similar to how Lot Owners and Home Owners are required to make monthly assessment payments.

Recent reviews of the 2016 “Developer Bailout” Land Deal uncovered many facts that bring into question the accuracy of accounting records as regards the Developer’s Required Assessments. The following is just a partial summary of questions that pop to mind in regards to some discrepancies found:

- We discovered at least 74 acres that were “purchased” by the POA from the Devleoper – but Pickens and Dawson County Tax Assessor Records showed that the POA already owned those lands. Was the Developer paying the required Assesment on this land if it did indeed own it, and have the right to sell it to the POA?

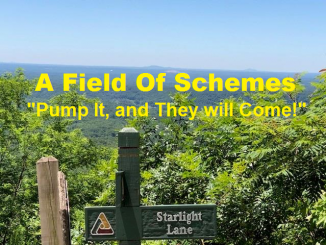

- The 2016 Land Deal was presented to the Property Owners as a Voter Referendum. The gist of the rational presented to Property Owners for why the should vote for approval, was that we were protecting the future of Big Canoe, and purchasing all Developer owned lands west of Steve Tate Hwy, otherwise known as “Mother Canoe”. Unfortunately, at least one very prominent tract of land (identified as Pickens County Parcel 049A 046 003 which s a huge 23 acre parcel that runs along the South side of the Big Canoe Main Gate Exit, and then south along Steve Tate Hwy over halfway to Cove Road) was NOT part of the Land Deal transaction, and appears to still be owned by the Developer, or a subsidiary of the Developer. Is the Developer still paying the required assessments? Below is a visual of the tract.

- It is unclear if the Developer is, or ever has been paying assessments on several large tracts of acreage that it has put into “shell/subsidiary companies” or “land trusts” over the years (i.e. Potts Mountain Investors, Main Gate Investors, High Gap Investors etc). I am not aware that the question has ever been asked, and due to all the questions arising, it does seem prudent to ask this question, and ascertain factually what the accounting record shows. Even now the Developer has in the deeds of sale for certain properties such as High Gap, and the land east of Steve Tate, retained the Developer Rights granted under the Declarations and Covenants, which may include the Developers Voting Rights. It is uncertain whether the Developer is equally living up to the assessment obligations for said lands, in return for said voting privileges and other retained rights.

Access to accounting records is the right of every property owner according to law. The GM and Board have so far refused every Records Request. It will be interesting to see if they honor this request, and even greater interest to see what is found. If the Developer has not been paying the legally required assessments, could their legal claim to other rights granted them be in jeopardy?

Be the first to comment